Originally published: November 2025 | Updated: December 2025 | Reviewed by Mary Conte

Recording a deed in Seminole County can feel confusing. The process involves fees, paperwork, and steps that trip up many property owners.

Whether you’re handing property to family, selling your home, or updating a deed after a significant life event, knowing the right steps up front will save you headaches and money.

Property owners in Seminole County must pay recording fees and, when there’s consideration, the Florida documentary stamp tax at $0.70 per $100 (or fraction) of the consideration.

Pure gifts with no consideration and no assumed debt generally do not incur doc stamps. If the grantee assumes or takes subject to a mortgage (or exchanges other value), tax is due on that amount.

Seminole County lets you record deeds in person, by mail, or via eRecording services. While each method has its quirks and timing, the basic fees and paperwork rules stay the same.

The Seminole County Clerk of the Circuit Court & Comptroller records all real property documents. If you want your deed on the official record, you’ve got to submit documents that are properly filled out, notarized, and signed by witnesses.

The clerk won’t assign an instrument number until everything checks out.

Every deed must list the full legal names of everyone involved, exactly as shown on earlier records. If you’re married, include both maiden and married names to steer clear of future title headaches.

The property description must match what’s on the current deed or survey. That means lot number, block, subdivision, and metes and bounds if needed. Mess this up and you’ll be waiting a while.

Florida’s notarization rules are tough. The notary must see you sign, check your photo ID, and have an active commission registered with the state.

You’ll also need two subscribing witnesses (18+) who observe the signing; they must print their names and mailing addresses beneath their signatures to satisfy F.S. 695.26.

Remote Online Notarization (RON) is permitted in Florida—make sure the notary’s certificate meets Chapter 117 requirements.

Once the Seminole County Recording Division accepts your deed, it assigns it a unique instrument number. That number is permanent and tracks the document forever.

The deed then gets posted in the official records database. You can search by instrument number and party name (and other index fields) in the Official Records search.

Digital images show the recording stamp, date, and instrument number. That’s your proof that the county accepted it.

Keep that instrument number with your important papers. You’ll need it for refinancing, selling, or any legal questions down the road.

Conte Mollenhauer Law makes Seminole County deed recording simple—fees clarified, eRecording guided, and rejections prevented with precise filings. Ready to record correctly? Contact us now.

If you’re ready to get started, call us now!

You’ve got three options: show up at the clerk’s office, drop your documents in the mail, or use electronic recording. Each way has its own rules and speed, so pick the one that fits your style (and timeline).

The Seminole County Clerk’s office handles all deed recordings for the county. Walk in during business hours and you’ll head to the recording department counter.

Staff will check your deed for the correct format and info. They’ll make sure you’ve got all the right signatures and that you’re following Florida’s recording rules.

They accept:

Fees depend on the number of pages. If there’s consideration, Florida charges doc stamps at $0.70 per $100 (or fraction) of the amount.

Pay all fees upfront. Staff will give you a receipt, and after acceptance, you’ll receive an instrument number; the image appears in Official Records.

Electronic recording lets you file deeds online, skipping the trip to the courthouse. It’s faster, and honestly, most people prefer it these days.

Most Florida counties, including Seminole, offer eRecording through secure portals. Just upload a PDF that meets their specs.

Some tips for eRecording:

The portal calculates fees at submission; you pay online. Turnaround is typically 24–72 hours after acceptance (mail usually takes longer).

You’ll get an email confirmation with the instrument number and a link to the recorded image in Official Records. Your original paper deed stays with you (you recorded the scanned PDF).

Recording a deed in Seminole County isn’t free. The costs depend on your document and the value of your property.

The base recording fee is $10.00 for the first page and $8.50 for each additional page.

Doc stamps cost 70¢ per $100 of the full sale price (rounded up). So, for $150,000 in property value, you’ll owe $1,050 in doc stamps. For $99,500, it’s $700.

Seminole County Deed Recording Fees

If there’s any consideration, tax is computed at $0.70 per $100 (or fraction) of that amount (so even $1–$100 rounds up to $0.70). Pure gifts with no consideration or assumed debt generally incur no doc stamps.

The Seminole County Clerk collects all recording fees when you drop off your documents. You can pay with cash, check, or money order.

Calculate your fees and doc stamps before you go. It’ll save time at the counter.

Florida’s documentary stamp tax applies to most deed recordings. The tax is $0.70 per $100 of value in most counties.

It’s important to know what counts as consideration and who usually pays, so you’re not caught off guard at closing.

The doc stamp calculation is based on the total consideration for the property. That means more than just the cash price.

Cash payments are the most common. If you buy a house for $300,000 cash, you pay doc stamps on the $300,000.

Assumed mortgages count, too. If you take over a $150,000 mortgage and pay $100,000 cash, you owe doc stamps on $250,000.

Property exchanges: doc stamps are based on the fair market value given/received (and any assumed debt).

Transfers with no consideration and no debt (e.g., certain gifts) generally do not incur doc stamps; if the grantee assumes/takes subject to debt, tax applies to that amount.

The county clerk rounds up to the next $100. If your property costs $299,500, you pay doc stamps as if it’s $299,600.

Florida law doesn’t prescribe who pays—the contract controls. In many counties, the seller typically pays the doc stamps on the deed, but parties can negotiate otherwise.

Sellers typically pay in most Florida counties. The standard FAR/BAR purchase contract imposes doc stamp costs on the seller unless both parties agree otherwise.

Buyers may pay in certain situations. Some contracts shift this cost to buyers, especially in hot markets or for unique deals.

Split arrangements happen occasionally. Sometimes buyers and sellers split doc stamp costs, or assign them differently, based on what they negotiate.

The purchase contract language decides who pays. Agents often add clauses like “Seller shall pay all documentary stamp taxes on the deed” or “Buyer shall be responsible for all recording costs and taxes.”

Negotiating doc stamp responsibility usually happens during contract talks. Buyers who ask for seller concessions might agree to pay these costs if it means getting something else in return.

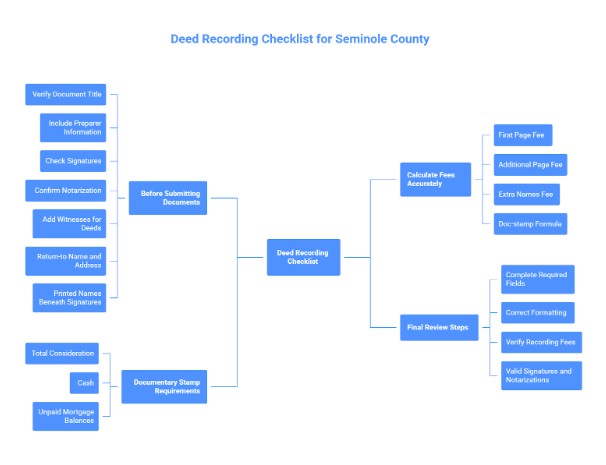

Recording a deed can feel overwhelming. If you follow the right steps, you’ll avoid most costly rejections.

This checklist helps you meet Seminole County requirements.

Document recording fees in Seminole County follow a standard structure:

| Fee Type | Cost |

| First page | $10.00 |

| Each additional page | $8.50 |

| Extra names (after first 4) | $1.00 each |

Doc-stamp quick formula (Seminole): Tax = ceil(Consideration ÷ 100) × $0.70.

The documentary tax stamp covers the total consideration. That means cash, unpaid mortgage balances, and anything else with monetary value.

Many people use eRecording services to avoid rejections due to incorrect fees. These services advance recording fees and handle submissions professionally.

Avoid miscalculating doc stamps or missing witness requirements; with Conte Mollenhauer Law by your side, filings stay clean and timely. Want peace of mind? Schedule an appointment.

If you’re ready to get started, call us now!

Seminole County offers eRecording through an online portal for small recording packages. They also use third-party networks for high-volume users.

Documents usually get recorded within 24 to 72 hours through these electronic systems.

The Seminole County Clerk’s eRecording portal is for individuals and small businesses who want to record documents from their office or home. It’s handy for people who don’t file documents very often.

The portal accepts certain document types, but the county doesn’t share a full list online. Most counties accept deeds, mortgages, and liens through eRecording.

Users can track their documents after submitting. Once recorded, they can immediately retrieve an image with recording info from the Official Records page.

The system sends email notifications when documents are processed. This saves you from courthouse trips and waiting in line.

High-volume filers (title companies, law firms, lenders) typically use third-party eRecording networks (e.g., Simplifile, CSC) that integrate with their systems for bulk submission and detailed tracking.

Third-party eRecording partners like Simplifile and CSC offer advanced features. They let you upload in bulk, automate document prep, and integrate with legal software.

Volume users pay subscription fees or per-document charges to these networks. The networks then submit documents to the county for you.

These systems often process documents faster than the public portal. They also give better tracking and customer support for business users.

Certain deed situations can really change recording costs or create legal headaches. Corrective deeds might avoid transfer taxes if handled properly. Miami-Dade’s tax structure is different from Seminole County’s rates.

If your deed mentions nominal consideration (e.g., ‘$10 and other’), DOR treats it as taxable ($0.70 minimum) even when no money changes hands.

Sometimes, property owners need to fix mistakes in previously recorded deeds. How they fix it determines whether they pay full documentary stamp taxes again.

Corrective deeds fix minor mistakes without creating a new transfer. These include things like:

If filed correctly, corrective deeds usually avoid new documentary stamp taxes. The property owner pays only the recording fees.

New conveyances create a new transfer and trigger full taxes. Examples are:

This distinction matters financially. Fixing a $200,000 property mistake might cost $30 in recording fees, but a new transfer could mean $1,400 in documentary stamps.

Property owners should consult a real estate attorney if they’re unsure. Filing incorrectly can lead to surprise tax bills or legal problems later.

Florida counties mostly follow the same documentary stamp tax rates. But Miami-Dade has special rules that don’t apply in Seminole County.

Miami-Dade deeds are $0.60 per $100; a $0.45 surtax per $100 applies except when the transfer is only a single-family dwelling, so in many cases the total is $1.05 per $100, not $1.30.

Seminole County uses Florida’s standard rates:

The difference is significant. A $300,000 home purchase means $2,100 in documentary stamp tax in Seminole County, but $3,900 in Miami-Dade.

Some property owners get confused and expect Miami-Dade rates when they look up Florida recording costs online. Seminole County follows the standard rates with no extra surtaxes.

This rate difference doesn’t affect property transfers between counties. Each county charges its own rates, no matter where the previous owner lived.

After the deed is recorded, property owners get official proof and can access copies through Seminole County’s system. The county assigns unique numbers for tracking and makes documents searchable in public records.

Once recorded, the deed becomes part of Seminole County’s Official Records, which the Clerk of the Circuit Court keeps. The county assigns each document a unique instrument number (image available in Official Records).

Property owners can search for their recorded deed online through the Seminole County Clerk’s website. The search lets you find documents by name, date, or document number.

Once accepted, the recording office stamps the document and gives it indexing numbers. This makes the deed part of the permanent public record.

In-person/mail: The original paper document is returned (include a self-addressed stamped envelope for mail).

eRecording: The scanned PDF is what records; keep your original paper deed. You’ll receive the instrument number and can access the recorded image online.

Seminole County offers two types of copies for recorded deeds. Certified copies have an official seal and signature, so they’re legally acceptable for court or official transactions.

Plain copies don’t have the official certification but cost less. They’re fine for personal records or informal uses where you don’t need legal authentication.

Copy Fee Structure:

eCertified copies can be purchased online and delivered via email; plain PDFs are free to download.

Property owners can request copies in person, by mail, or online through the county’s system. Processing times vary depending on how you request and on the clerk’s office’s workload.

Property buyers and sellers in Seminole County really need to figure out their recording fees and documentary stamp taxes before closing. These costs can pile up fast, so planning makes a difference.

Documentary Stamp Tax Rates:

| Document Type | Rate |

| Deeds | 70¢ per $100 (or fraction thereof) |

| Mortgages | 35¢ per $100 (or fraction thereof) |

Doc Stamps — $0 vs. Due (Seminole County)

Doc stamps apply to the total consideration given (cash, value exchanged, or assumed debt) and are computed at $0.70 per $100 (or fraction) in Seminole County.

Pure gifts with no consideration and no assumed debt are generally $0. If a deed states nominal consideration (e.g., “$10 and other”), the minimum tax ($0.70) applies.

Recording Fees:

People can try out online calculators to get a rough idea of their total costs before heading to the clerk’s office. These tools make it easier for buyers to budget for closing.

The total consideration includes cash, existing mortgages, and any other assets of value. So, you end up calculating documentary stamps on more than just the down payment.

Use the Clerk’s fee schedule for recording costs and compute doc stamps with the formula below or a trusted third-party calculator.

Important Note: Fees might change without warning. It’s always smart to check with the clerk’s office for the latest rates before recording anything.

Close your recording confidently—calculate the consideration correctly, file via the portal, and retrieve certified copies quickly, then move on. Powered by Conte Mollenhauer Law. Contact us.

Where do I record a deed in Seminole County, and what filing methods are available?

Record with the Seminole County Clerk of the Circuit Court & Comptroller—in person, by mail (include payment and a self-addressed stamped envelope), or via the Public eRecording Portal.

How much does it cost to record a deed in Seminole County?

$10.00 for the first page, $8.50 for each additional page; +$1.00 per name after the first four for indexing; copies $1.00/page and certification $2.00 per instrument.

What is Florida’s documentary stamp tax for deeds in Seminole County, and how do I calculate it?

Deed doc stamps are $0.70 per $100 (or fraction) of consideration (cash/value given and any assumed debt)—rounded up to the next $100. Formula: Tax = ceil(Consideration ÷ 100) × $0.70. Pure gifts with no consideration and no debt are generally $0.

Do gifts, nominal consideration, or assumed mortgages change the doc stamp amount?

Pure gifts with no debt usually owe $0. If the grantee assumes or takes subject to a mortgage, the tax applies to that debt amount; instruments stating nominal consideration (e.g., “$10 and other”) trigger at least $0.70.

What signatures, witnesses, and formatting are required to avoid rejection?

Deeds executed in Florida require two subscribing witnesses (RON permitted) and must meet F.S. 695.26 formatting—include printed names and mailing addresses for witnesses and other required parties.

Can I e-record a deed in Seminole County, and how long does it take?

Yes—submit a compliant PDF through the Public eRecording Portal; typical turnaround is ~24–72 hours after acceptance, with email confirmation and an instrument number when recorded.

How do I find my recorded deed and get copies?

Search the Official Records by instrument number or party name; plain copies are generally $ 1 per page, and certified copies add $2 per instrument (paper or eCertified, when available).