Originally published: August 2024 | Updated: December 2025 | Reviewed by Mary Conte

Putting your house into a trust in Florida can sound daunting at first. Still, many homeowners end up feeling relieved once they’ve done it.

This process means transferring your home’s title to a trust. You can keep your homestead benefits, dodge probate, and protect your property for your loved ones.

Placing a house into a trust is a common estate planning strategy—but you have to pay close attention to Florida’s rules.

Most Florida homeowners worry about losing their valuable homestead exemption. The good news: with the right planning, you can structure the trust to keep your property tax exemptions and other homestead protections.

But, let’s be honest—one wrong move can lead to costly mistakes or headaches you just don’t need.

Putting your house into a trust in Florida involves seven main steps. You’ll need to pay attention to homestead protection rules and know how taxes and mortgage requirements work.

Putting your Florida home into a trust involves several clear, legal steps. Here’s how the process compares at a glance.

| Step | Action | Why It Matters |

| 1 | Choose the right trust type | Keeps control & preserves homestead |

| 2 | Draft Florida-specific trust documents | Avoids invalid language |

| 3 | Transfer the deed to the trust | Legally changes ownership |

| 4 | Record the deed with the county clerk | Makes it official |

| 5 | Notify insurers & lenders | Prevents policy or mortgage issues |

| 6 | Update tax & appraisal records | Maintains exemptions |

| 7 | Store all documents securely | Protects future access |

Your property taxes don’t change if you use a revocable living trust—the homestead exemption stays. Mortgage payments don’t budge.

You still live in your home, as you always have. Insurance coverage keeps going if you update it.

The trust name goes on all the legal documents. You’re no longer listed as the owner; the trust is.

For revocable trusts, you still report income or gains on your own tax return. Nothing new there.

Most lenders want to know if you put your home in a trust. Some mortgages have due-on-sale clauses, but federal law usually protects transfers to revocable living trusts.

It’s smart to call your lender before you transfer. That way, you won’t accidentally trigger a loan problem.

In Florida, your choice between a revocable and irrevocable trust affects control, flexibility, and asset protection. Here’s a quick comparison.

With a revocable trust, you keep full control. You can change it, cancel it, or pull your house out whenever you want. Most folks go with this for their main home.

You stay in charge. You can sell, refinance, or tweak the trust at any time.

With an irrevocable trust, you can’t just change your mind. Once you put your house in, you give up direct control. But you get stronger asset protection.

| Trust Type | Control Level | Flexibility | Asset Protection |

| Revocable | Full control | High | Limited |

| Irrevocable | Limited control | Low | Strong |

Most people in Florida stick with revocable trusts for their homes. It lets them keep their tax benefits and control.

Irrevocable trusts work best for specific situations, such as Medicaid or special needs planning. They’re tough to change, so you have to plan carefully.

Your goals, age, health, and family all play a part in which trust fits best. There’s no one-size-fits-all answer here.

At Mary Conte Law, we help Florida families safeguard their homes and maintain their homestead protections. Schedule your trust planning consultation today.

If you’re ready to get started, call us now!

Homestead—How To Keep Your Benefits After Transfer

You won’t lose Florida homestead exemptions if your trust keeps you as the lifetime beneficiary and maintains your control over the property.

Florida law protects your homestead benefits when you move property into certain trusts. But you have to meet some conditions.

The transfer needs to let you keep living in the property and stay in control while you’re alive.

In Florida, you can move your homestead into a revocable trust without losing protection if you follow the rules. You have to keep the right to live there for life.

Your trust must make it clear that you keep full control. You should be able to sell, mortgage, or change the property whenever you want.

Key Requirements:

You should refile for the homestead exemption after the transfer to keep your tax breaks. Some counties ask for a new application if the trust becomes the owner.

Property appraisers usually treat these transfers as non-taxable events. The Save Our Homes cap sticks if you show the right paperwork.

Florida Statute 732.4017 draws a line between lifetime transfers and gifts in a will (“devises”). If you move your house into a revocable trust while alive, it’s not a “devise” under probate law.

This matters because you can’t leave homestead property in a will if you have a spouse or minor kids. But if you use a revocable trust during your lifetime, those restrictions don’t apply.

| Scenario | Probate Effect | Homestead Protected? |

| Transfer by will (“devise”) | Subject to probate | ❌ No |

| Transfer via revocable trust | Avoids probate | ✅ Yes |

| Transfer via an irrevocable trust | Partial protection | ⚠ Depends on terms |

Legal Requirements:

The statute protects family rights while still allowing you to do smart estate planning. Courts look at what really happened, not just the paperwork.

If you set up the trust right, you keep all your homestead protections. The property stays safe from most creditors, and you keep your tax benefits.

Florida Statute 732.7025 allows spouses to waive certain homestead rights in writing. You can put this waiver in your trust if both spouses agree.

The waiver must be in writing and signed by the spouse giving up rights. The court wants proof that the spouse knew what they were giving up.

Waiver Considerations:

Lots of married couples add mutual waivers to their trusts. It helps avoid arguments later about who controls the property.

The waiver doesn’t take away tax breaks or creditor protection while the owner is alive. It mostly changes what happens after death.

The actual deed document transfers legal ownership from the homeowner’s name to the trust’s name.

Florida attorneys usually use specific deed types and include careful language to protect homestead exemptions during this transfer.

Most Florida attorneys reach for warranty deeds when moving homes into trusts. They want to protect the homeowner and trust beneficiaries.

A warranty deed guarantees the homeowner has a clear title to transfer. It also promises that no hidden liens or ownership problems are lurking in the background.

Quitclaim deeds work differently. They just transfer whatever ownership rights the person might have—no promises, no guarantees.

| Deed Type | Best Use | Includes Title Warranty? |

| Warranty Deed | Standard homeowner transfer | ✅ Yes |

| Quitclaim Deed | Family or informal transfers | ❌ No |

Why are warranty deeds preferred?

Some attorneys use quitclaim deeds in simple family situations. Still, warranty deeds offer better protection for most homeowners putting their house in trust.

The deed transfer process requires proper preparation to avoid headaches down the road.

Every deed transferring Florida property to a trust needs certain legal elements. If you miss one, the transfer can fall apart.

Essential deed elements include:

The trust name has to match exactly what’s in the trust document. Even a small spelling mistake can cause issues.

The legal property description comes from the current deed or county records. Street addresses alone just don’t cut it for legal transfers.

In Florida, the homeowner’s signature must be notarized. Two witnesses must also sign the deed in front of the notary.

Specific language in the deed helps protect the homestead exemption in Florida. This is huge for property tax savings and creditor protection.

Key protective phrases include:

The deed should make it clear that the homeowner stays the primary beneficiary. That’s what keeps homestead status safe under Florida law.

Many attorneys add language like: “Grantor reserves all homestead rights, exemptions, and benefits available under Florida law.”

The homestead protection can continue even with trust ownership if you use the right language.

Some deeds also mention the homeowner’s right to live in the property. That extra bit can make homestead protection even stronger.

Recording costs usually range from $30 to $50 for primary residences in Florida counties.

Before you file your deed, talk with Mary Conte Law. We ensure your transfer language complies with Florida homestead rules and avoids unnecessary taxes. Contact us for guidance.

If you’re ready to get started, call us now!

Recording costs vary by county, but most homeowners pay between $10 and $50, depending on document length and format.

| Fee Type | Typical Range | Notes |

| Recording fee (first page) | $10–15 | Each county differs |

| Additional pages | $1 each | Deeds often 2–3 pages |

| Electronic filing | +$3–5 | Optional convenience charge |

| Doc stamp tax | $0.70 per $100 value | Only if consideration applies |

The county returns a recorded deed showing the date, book, and page numbers—your proof of ownership under the trust.

Property owners must record their trust deed at the county clerk’s office where their home sits. Each Florida county operates its own clerk of the court’s office for real estate recordings.

Most counties now offer online recording services. Electronic recording saves time and money and spares you trips to the courthouse.

Popular counties and their recording offices include:

| County | Office Location | Online Recording Available |

| Miami-Dade | Downtown Miami | Yes |

| Broward | Fort Lauderdale | Yes |

| Orange | Orlando | Yes |

| Hillsborough | Tampa | Yes |

| Palm Beach | West Palm Beach | Yes |

Homeowners should check their specific county’s website for addresses and hours. Some offices accept mail-in submissions with the proper fees.

Standard recording time runs 2–3 business days after the clerk gets the deed. Electronic submissions usually process faster than paper filings.

The county will return a recorded deed showing the official recording date and the book/page numbers. This stamped document confirms that the transfer is complete.

Recording fees vary by county but typically cost:

Some counties charge extra for oversized documents. It’s a good idea to call ahead to check the exact fees and payment methods.

Once recorded, the deed is entered into the public records. Now there’s an official paper trail showing the home belongs to the trust.

After recording, homeowners need to update their homeowner’s insurance policy to show the trust as the new owner. Most insurance companies want written notice of ownership changes.

The insurance policy should list the trust name exactly as it appears on the recorded deed. Skipping this step could leave coverage gaps if you ever file a claim.

Tax professionals want copies of the recorded deed for their files. CPAs and tax preparers use this document to report rental income or capital gains tied to the property.

Homeowners should also let their mortgage company know if there’s a loan. Most trusts don’t trigger due-on-sale clauses, but lenders like to be kept in the loop.

Keep the original recorded deed in a safe place with other trust documents. Make a few copies for future reference or extra filings.

Most Florida homeowners get nervous about their mortgage when they move property into a revocable trust.

Federal law protects these transfers, and insurance companies usually work with trust ownership if you get the right endorsements.

The Garn-St. The Germain Act protects homeowners who put their house with a mortgage into a revocable trust.

This federal law prevents lenders from declaring the loan due when property is transferred to a living trust.

The protection applies only to revocable trusts in which the borrower is the beneficiary. The homeowner must continue living in the property as their primary residence.

Key requirements include:

Most mortgage contracts have due-on-sale clauses. These usually let lenders demand full payment when ownership changes. But trust transfers are specifically exempt from triggering these clauses under federal law.

Homeowners don’t need a lender’s permission to transfer property to a revocable trust. The federal exemption makes this transfer a right, not something you have to ask for.

Some homeowners notify their lender anyway to avoid confusion when new property records list the trust as the owner.

Benefits of notifying the lender:

The notification should include copies of the trust document and the deed. Some lenders might ask for extra paperwork to update their records.

Homeowners shouldn’t ask for permission since that suggests the lender can say no. Instead, just provide a courtesy notification and cite the federal protection if needed.

Homeowners’ insurance policies need to be refreshed when property is transferred to a trust. The trust becomes the new owner and should be listed as the insured party.

Most insurance companies add trust endorsements to existing policies. This usually costs less than buying a brand-new policy and keeps your coverage going without a hitch.

Required policy changes:

The homeowner should call their insurance agent before finishing the property transfer. Some companies want the endorsement in place before you record the deed.

Florida law requires continuous insurance coverage on mortgaged properties. If there’s a gap, the lender might buy expensive force-placed insurance and bill the borrower for it.

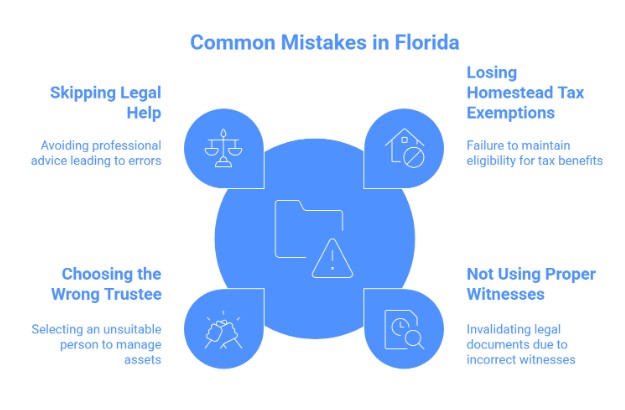

Many Florida homeowners make costly mistakes when putting their homes into a trust. These mistakes can lead to lost tax benefits and legal headaches.

The biggest mistake is losing valuable homestead protections that can save up to $50,000 in taxes. This happens if you don’t structure the trust right.

Fix: Use a revocable living trust with the homeowner as trustee. Transferring the homestead into the trust should not affect the homestead tax exemptions when done properly.

Florida has specific signing rules. People often forget they need two witnesses plus a notary when signing the deed.

Fix: Always sign the deed in front of a notary and two witnesses, as required by Florida law.

Some folks pick trustees who don’t really get what they’re supposed to do. Others choose someone who lives far away or has money problems.

Fix: Pick a trustee who is responsible, local, and understands the job. Many homeowners just start as their own trustee.

While you don’t need an attorney to put your house in a trust in Florida, doing it alone often leads to mistakes. Fixing those errors later costs more than hiring help upfront.

Fix: Work with an experienced Florida estate planning attorney who understands homestead laws.

| Mistake | Impact | Fix |

| Forgetting witnesses | Deed invalid | Re-execute with notary & two witnesses |

| Losing the homestead exemption | Higher taxes | Use a revocable trust with retained rights |

| Skipping legal advice | Invalid trust | Hire a Florida estate attorney |

| Failing to record a deed | No legal ownership change | File with the county clerk |

Most homeowners spend somewhere between $1,500 and $3,500 to put their house in a Florida trust. The actual cost varies depending on property value and the complexity of the trust setup.

Specific scenarios absolutely require legal help, especially when homestead exemptions are involved. You don’t want to mess that up—it’s just not worth the risk.

The cost to put a house in a trust breaks down into a few main expenses you’ll want to plan for:

Attorney Fees: $1,000 to $2,500

Most estate planning attorneys charge in this range for trust creation and property transfer. If your trust is more complex or your property is worth a lot, expect that number to climb.

Document Preparation: $200 to $500

Recording Fees: $50 to $150

County clerk offices charge to record the new deed. The amount depends on your county, but it usually falls between $50 and $150.

Title Insurance: $300 to $800

You might need new title insurance when moving property into a trust. The price depends on your property’s value.

Notarization: $10 to $30

Florida requires notarization for deed transfers. Sometimes attorneys include this in their fees, but not always.

Florida law creates a few situations where you really need a professional attorney on your side, no question:

If your property has a homestead exemption, get expert guidance. Transferring homestead property to a trust can mess with your tax benefits and creditor protection if you don’t do it right.

These need careful handling. Lenders might call your loan due if the transfer triggers an acceleration clause—definitely not something you want to find out the hard way.

Things get complicated fast when multiple owners are involved. Attorneys ensure everyone’s rights are protected during the transfer.

Investment properties or rentals can have tricky tax consequences if you don’t plan. You’ll want a pro to analyze the risks.

Florida’s asset protection laws are unique. If you want to keep those benefits, let a legal expert guide you through the process.

Mary Conte Law helps Florida homeowners set up and record their trusts properly—preserving homestead benefits, minimizing taxes, and protecting your family’s future. Schedule your consultation today.

At Mary Conte Law, we understand that putting your Florida home into a trust isn’t just a legal step—it’s a personal one. Every family has its own story, and we take the time to listen before we draft a single document.

Our goal is to help you protect what matters most with clarity, confidence, and care.

Many Florida homeowners come to us worried about making the wrong move or missing a critical detail.

We simplify the process, explaining every clause in plain English so you can make informed choices without feeling overwhelmed.

We believe good legal planning means more than filling out forms—it’s about creating a plan that grows with you.

From preparing trust documents to transferring property titles, we walk beside you with consistent, dependable support.

| Service | How It Helps Florida Homeowners |

| Trust & estate document preparation | Ensures every clause meets Florida legal standards |

| Property title transfer | Handles county filings for accurate ownership transition |

| Homestead & tax protection | Preserves key exemptions and financial safeguards |

| Family education & support | Clarifies trustee roles and next-step planning |

Over the years, Mary Conte Law has helped countless Florida families bring order and peace of mind to their estate plans.

When life changes, we’re still here—ready to adjust your plan, answer new questions, and keep your legacy secure for generations to come.

Does putting my house in a trust affect my Florida homestead exemption?

No, not if you use a properly structured revocable living trust. As long as you keep lifetime occupancy and control, your homestead protections remain intact.

Will I owe documentary stamp tax when transferring my home to a trust?

Usually no. Transfers to a revocable living trust with no sale or mortgage assumption are non-taxable under Florida law.

Can I refinance my home after it’s in a trust?

Yes. Most lenders allow refinancing if you’re the trustee and beneficiary. Some may temporarily require the property to be deeded back and then retitled into the trust after closing.

Is a lawyer required to put my house in a trust in Florida?

It’s not required, but strongly recommended. Errors in trust language or homestead treatment can void your exemptions or create title problems later.

How much does it cost to transfer a house into a trust?

Most Florida homeowners spend between $1,500 and $3,500, depending on complexity, recording fees, and title work.

What’s the difference between a revocable and an irrevocable trust for my home?

A revocable trust lets you keep complete control and amend the terms. An irrevocable trust locks the terms but offers stronger asset protection.

Can I add my spouse or children to the trust later?

Yes. Revocable trusts can be updated to include family members as co-trustees or beneficiaries—just make sure the changes are correctly signed and notarized.