Originally published: February 2025 | Reviewed by Mary Conte

Florida stands apart from many states when it comes to gift taxes. Florida does not impose a state-level gift tax, making it an attractive place for those planning to transfer assets to family members or others.

This tax-friendly approach has existed since the state repealed its gift tax in 2004.

While you won’t face state gift taxes in Florida, federal gift tax rules still apply. For 2025, you can give up to $19,000 per person annually without triggering tax implications.

Married couples can combine their allowances to give $38,000 per recipient each year.

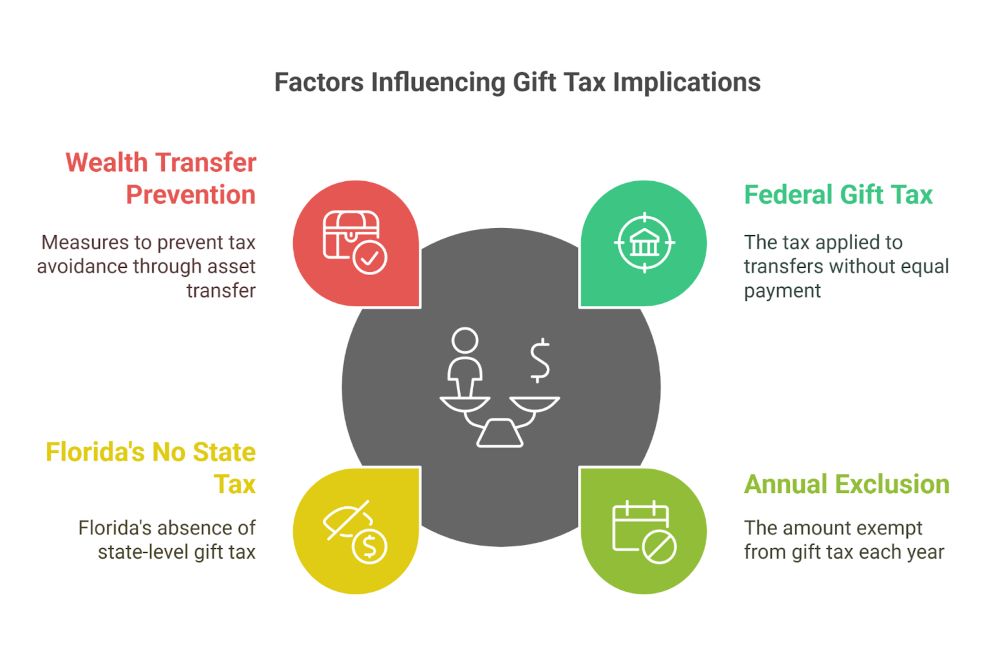

Gift taxes are charges the government collects when you give money or property to another person. In the United States, this tax system helps prevent people from avoiding estate taxes by giving away their assets before death.

A federal gift tax applies when you transfer something of value to another person without getting payment of equal worth in return. This includes cash, property, and other valuable items.

The IRS created gift taxes to stop wealthy people from giving away their money to avoid estate taxes. These rules ensure that the government collects fair taxes on wealth transfers.

You don’t need to pay gift taxes on small gifts. For 2025, you can give up to $19,000 per person each year without owing any tax. This is called the annual exclusion.

Florida stands out because it does not have a state-level gift tax. The state removed its gift tax in 2004, making it more appealing for wealth transfers.

You still need to follow federal gift tax rules when living in Florida. The lack of state gift tax doesn’t change your federal obligations.

Many people move to Florida for tax benefits. The state’s tax-friendly policies, including no gift tax, make it popular for retirement and estate planning.

The IRS maintains strict rules about monetary gifts between individuals. For 2025, you can give up to $19,000 per person without triggering tax implications.

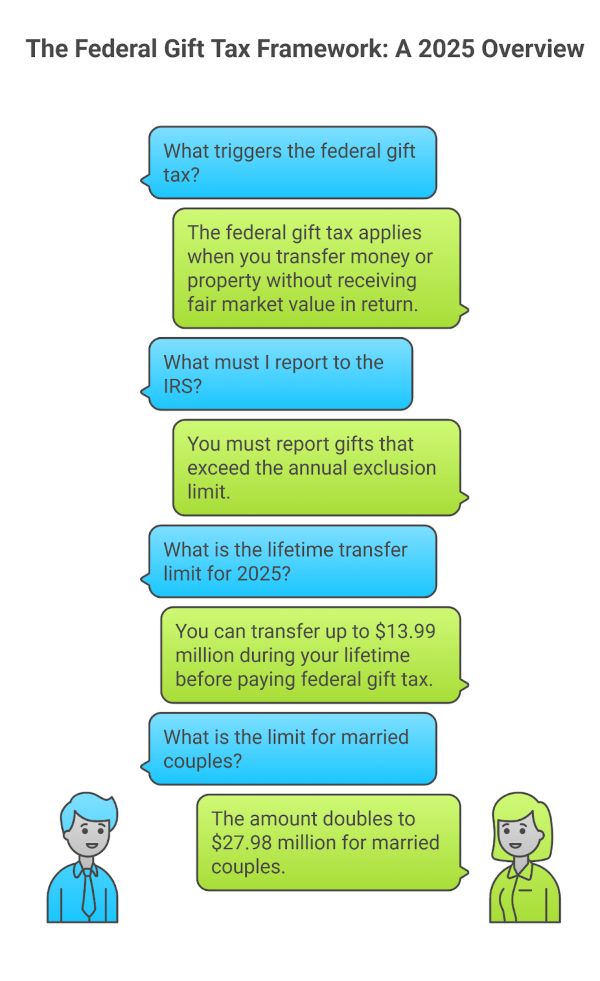

The federal gift tax applies when you transfer money or property to another person without receiving fair market value in return. You must report gifts that exceed the annual exclusion limit to the IRS.

In 2025, you can transfer up to $13.99 million during your lifetime before paying federal gift tax. This amount doubles to $27.98 million for married couples.

Key Annual Limits for 2025:

The IRS requires you to file Form 709 when your gifts exceed the annual exclusion amount. This form helps track your lifetime gift-giving against your exemption limit.

Gifts between spouses typically don’t trigger tax consequences. Educational and medical expenses paid directly to institutions also remain exempt.

The IRS can audit gift tax returns for up to three years after filing. Penalties apply for unreported gifts that exceed the annual limit.

Unless Congress takes action, the current high exemption levels will drop significantly in 2026 to approximately $7.2 million per person.

Annual gift exclusions continue rising with inflation. The $19,000 limit for 2025 represents a $1,000 increase from 2024.

The Tax Cuts and Jobs Act temporarily doubled the lifetime exemption, but this provision expires after 2025. You may want to consider making larger gifts before the exemption decreases.

Thinking about gifting assets but unsure of the tax rules? Mary Conte Law can help you navigate estate planning in Florida—ensuring your generosity remains tax-efficient. Schedule a consultation today.

If you’re ready to get started, call us now!

Florida residents enjoy tax-friendly benefits when making monetary gifts. The state stands apart from many others due to its generous tax policies.

Florida does not have a state gift tax. This means you won’t pay any state-level taxes on gifts you give to others while living in Florida.

The federal government still requires you to follow its gift tax rules. These rules apply no matter which state you live in.

You must report gifts that exceed the annual federal exclusion limits to the IRS. For 2025, this limit is $19,000 per person per year.

You can give unlimited gifts to your spouse without tax consequences if they are a U.S. citizen.

The federal lifetime gift tax exemption allows you to give away millions without paying gift tax. In 2025, this amount will be adjusted for inflation.

Important Gift Tax Exclusions:

Many people think all gifts are taxable. This isn’t true. You only need to report gifts above the annual exclusion amount.

Another myth is that receiving a gift triggers tax liability. The gift tax is always paid by the giver, not the receiver.

Some believe moving to Florida means escaping all gift taxes. While Florida has no state gift tax, federal gift tax rules still apply to you as a Florida resident.

Remember: Keep records of large gifts. Even if you don’t owe tax now, these records may be important for future estate planning.

The federal gift tax threshold is $19,000 per person for 2025. Any gifts above this amount need to be reported to the IRS, though you may not owe taxes right away.

Money and property transfers count as taxable gifts when they exceed the annual exclusion limit. This includes cash, real estate, vehicles, and investments.

You must report gifts over $19,000 to a single person using IRS Form 709. These amounts count against your lifetime exemption of $13.99 million.

Common Taxable Gifts:

You can give unlimited gifts to your spouse without tax implications if they are a U.S. citizen.

Special rules apply when paying someone’s medical or education expenses. Direct payments to medical providers or educational institutions don’t count toward the gift tax limit.

The lifetime gift tax exemption combines with your estate tax exemption. This means large gifts during your life reduce the amount you can transfer at death tax-free.

Donations to qualified charities are not subject to gift tax limits. You can give unlimited amounts to eligible non-profit organizations.

Gifts to individuals follow different rules:

Keep detailed records of all gifts exceeding the annual exclusion. This helps track your remaining lifetime exemption.

Essential Documentation:

Create a simple tracking system for annual gifts. A spreadsheet noting recipient names, gift dates, and amounts helps prevent exceeding limits.

Store gift tax returns and supporting documents for at least 7 years after filing.

The laws around gift taxes can be complex, but with expert estate planning from Mary Conte Law, you can protect your wealth while maximizing tax benefits. Get tailored guidance—book your appointment now!

If you’re ready to get started, call us now!

Smart gift tax planning helps preserve wealth and reduce tax burdens. Several proven strategies allow you to transfer assets while minimizing or eliminating gift taxes.

In 2025, you can give up to $19,000 per person without triggering gift tax. Married couples can combine their exclusions to give $38,000 per recipient.

To maximize this benefit, spread gifts across multiple years and recipients. For example, if you have three children, you could give each $19,000 annually for a total of $57,000 in tax-free gifts.

Consider splitting large gifts between December and January to use two years’ worth of exclusions.

Strategic trust planning helps protect your assets while reducing tax exposure. Irrevocable trusts remove assets from your taxable estate.

Popular Trust Options:

These tools can help you transfer wealth while retaining some control or income streams. Each type serves different purposes and offers unique tax advantages.

Plan your gifts carefully before the 2025 tax law changes. The current lifetime gift tax exemption is historically high but set to decrease significantly.

Making substantial gifts now lets you lock in today’s higher exemption amounts. Consider gifting appreciating assets early to transfer future growth outside your estate.

Breaking up large gifts into smaller amounts over time helps you stay within annual exclusion limits.

Estate attorneys bring vital experience to help you navigate Florida’s complex gift tax laws and protect your assets. Their professional guidance can save you money and prevent costly mistakes in your estate planning journey.

A qualified estate attorney helps you make smart decisions about your assets and future plans. Their expertise prevents expensive tax errors that could impact your family’s financial security.

Gift tax rules change frequently, and tax law changes in 2025 will affect many Florida residents’ estate plans.

Your attorney will collaborate with your financial advisor to create a comprehensive strategy. This team approach will ensure legal compliance and optimal financial outcomes.

Key benefits of professional guidance:

Look for attorneys who specialize in estate and gift tax planning. Experience with Florida-specific estate laws is essential.

Ask potential attorneys about their experience with cases similar to yours. Request references from current clients.

Important qualities to consider:

Check professional associations and bar memberships to verify credentials.

Florida has no state-level gift tax, making it friendlier for wealth transfers than many other states.

The federal gift tax annual exclusion lets you give up to $19,000 per person in 2025 without filing a gift tax return.

You must track your gifts carefully and keep good records. This will help you stay within your limits and avoid unexpected tax bills.

Consider working with a tax professional for large gifts or complex transfers. They can help you plan the best timing and structure for your gifts.

The federal estate and gift tax rules may change after 2025 when current tax laws expire.

You should review your gift-giving strategy yearly. Tax laws can change quickly, and staying flexible helps you adjust your plans.

A qualified tax advisor can help you spot new opportunities and avoid problems as rules change.

Avoid costly tax mistakes and secure your legacy with smart estate planning. Mary Conte Law provides personalized strategies to help you make informed financial decisions. Contact us today to safeguard your future!

Does Florida have a gift tax?

No, Florida does not impose a state-level gift tax; however, federal gift tax rules still apply to residents.

How does gift tax affect Florida residents?

Florida residents only need to worry about the federal gift tax. Gifts exceeding the annual exclusion limit must be reported on Form 709, but no additional state tax is imposed.

What should I know about Florida and gift tax planning?

While Florida does not have its own gift tax, effective estate planning is important to manage federal gift tax exposure and protect your legacy.

What types of gifts are exempt from gift tax?

Gifts that do not exceed the annual exclusion, payments made directly for tuition or medical expenses, gifts to a qualifying charity, and gifts to a U.S. citizen spouse are generally exempt.

Are gifts to family members always taxable?

A: No, gifts up to the annual exclusion amount per recipient are not taxable, and even larger gifts can be tax-free if they fall within the lifetime exemption.

When do I need to file an IRS gift tax return?

You must file Form 709 if you give a gift over the annual exclusion amount to any individual during a tax year.

How do I file an IRS gift tax return?

Use IRS Form 709, which is filed with your annual tax return (or separately, if required). Follow the instructions provided by the IRS for proper reporting.

What is the annual gift tax exclusion for 2025?

In 2025, the annual gift tax exclusion is $19,000 per recipient, allowing you to gift this amount tax-free each year.

Can married couples combine their annual exclusion?

Yes, in 2025, married couples can “split” gifts together and give up to $38,000 per recipient tax-free.

What is the lifetime gift tax exemption for 2025?

The lifetime gift tax exemption in 2025 is $13.99 million per individual, meaning gifts beyond the annual exclusion will count against this large exemption before any tax is due.

How does the lifetime exemption affect my estate plan?

Using your lifetime exemption for larger gifts can lower your taxable estate, but it will reduce the amount available to shelter your estate at death.