Starting a business in Florida requires careful planning and choosing the right structure. Florida ranks as the fifth most favorable state for LLCs, making it an attractive option for entrepreneurs.

A Limited Liability Company provides personal asset protection, tax flexibility, and simpler management compared to corporations while maintaining the benefits of limited liability protection.

LLCs in Florida enjoy zero state-level taxation and offer flexibility in how they’re taxed at the federal level.

Business owners can choose between different LLC structures based on their needs, from single-member operations to professional service companies.

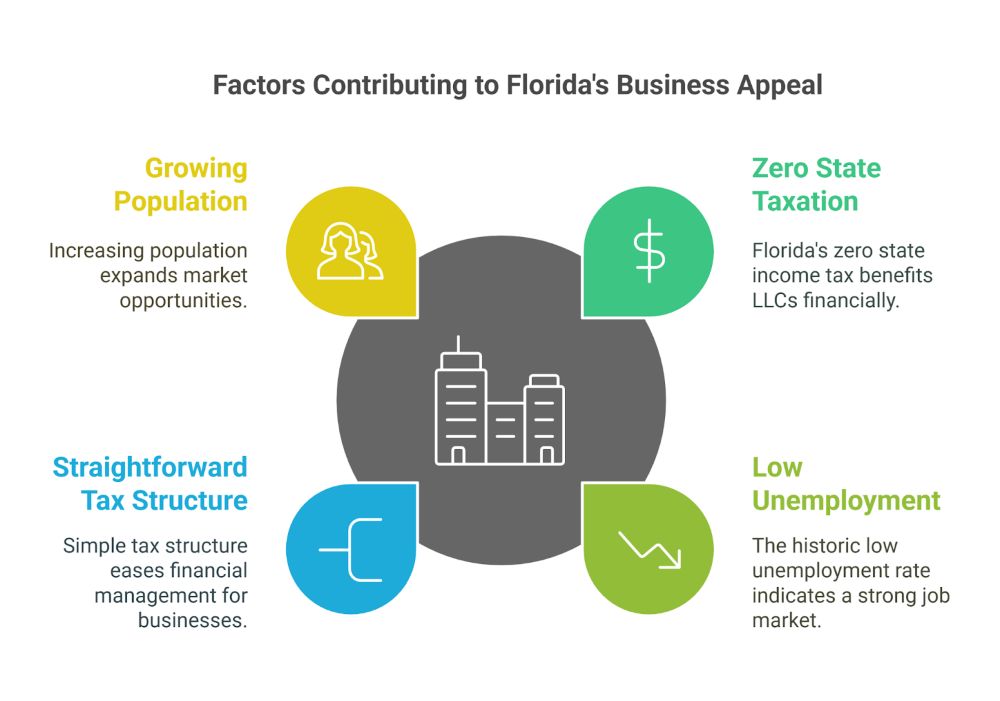

Florida ranks among the top U.S. states for business-friendly policies. It has zero state income tax and strong legal protections for companies.

Florida stands out with its zero state-level taxation for LLCs, making it highly attractive for business owners. The state’s unemployment rate reached historic lows, showing a robust job market.

Business owners benefit from Florida’s straightforward tax structure. Companies only pay federal taxes and minimal state filing fees.

The state’s growing population creates expanding market opportunities. Many businesses relocate to Florida each year to take advantage of the favorable conditions.

Limited liability companies in Florida offer strong asset protection while maintaining operational flexibility. The LLC structure shields personal assets from business debts and legal claims.

Different business entities provide varying levels of protection:

Florida law allows single-member LLCs, making it easy for individual entrepreneurs to start businesses. The state’s streamlined LLC formation process requires minimal paperwork and reasonable filing fees.

Making smart choices about business structure requires careful analysis of legal protections, operational control, and Florida’s specific requirements.

Liability protection in Florida LLCs creates a barrier between business debts and personal assets. This shields your home, savings, and other personal property from business claims.

The management structure can be either member-managed or manager-managed. Member-managed works well for small businesses where owners handle daily operations. Manager-managed suits larger companies with passive investors.

Florida LLCs benefit from no state income tax, making them tax-efficient. They must maintain a registered agent and file annual reports by May 1st.

Operating agreements define:

The flexible structure allows changes without complex paperwork. Members can modify roles and responsibilities as the business grows.

Setting up an LLC in Florida? Mary Conte Law ensures your business structure protects your assets and meets legal requirements. Get expert guidance today—schedule your consultation now!

If you’re ready to get started, call us now!

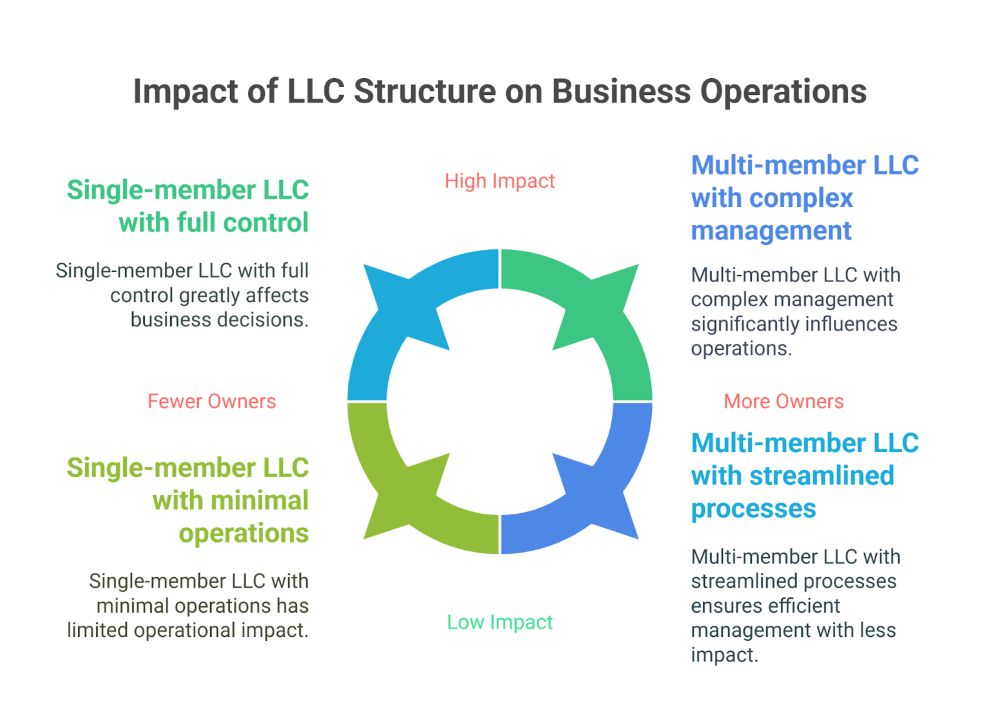

The structure and number of owners in an LLC significantly impact taxation, management control, and business operations. These differences affect daily operations and long-term business success.

A single-member LLC has one owner, while a multi-member LLC requires two or more owners. Both types provide limited liability protection for the owner’s personal assets.

Single-member LLCs operate under simpler management structures. One person makes all decisions and handles operations without needing approval from others.

Multi-member LLCs need a detailed operating agreement that outlines ownership percentages, voting rights, and profit distribution. This document prevents future disputes between members.

| Single-Member LLC Benefits | Single-Member LLC Drawbacks |

| Complete control over business decisions | Limited access to capital and resources |

| Simpler tax filing as a disregarded entity | All responsibilities fall on one person |

| Less paperwork and administrative tasks | It may appear less credible to large clients |

| Multi-Member LLC Benefits | Multi-Member LLC Drawbacks |

| Shared workload and responsibilities | Potential conflicts between members |

| Combined expertise and resources | More complex tax requirements |

| Greater access to startup capital | Shared decision-making slows processes |

Choose a single-member LLC for small operations where maintaining full control is essential. This structure works well for freelancers, consultants, and small retail businesses.

Multi-member LLCs suit businesses planning significant growth. They work best when different members bring unique skills or resources to the company.

Consider a multi-member LLC when the business needs substantial startup capital or diverse expertise. This structure fits well for real estate investments, professional services firms, and technology startups.

A single-member LLC makes sense for those who want to keep operations simple and maintain independence in decision-making.

A Series LLC creates multiple protected business segments under one master company, each with its own assets and liabilities.

This structure offers both flexibility and protection for businesses with multiple ventures or properties.

A Series LLC functions like a parent company that holds separate business units. Each unit operates independently with its own assets, debts, and management structure.

Delaware stands out as the preferred state for Series LLC formation due to its business-friendly laws and streamlined processes.

Setting up requires creating individual series within the larger LLC. Each series maintains separate books, bank accounts, and operating agreements.

The tax implications vary. When the master LLC owns 100% of each series, only one tax return may be needed since wholly-owned LLCs are typically disregarded entities for tax purposes.

Florida currently does not have Series LLC legislation. This creates uncertainty for Florida businesses interested in this structure.

The Florida Bar advocates for Series LLC adoption based on growing recognition in other states. Currently, 21 jurisdictions recognize Series LLCs.

Florida businesses must consider the implications of forming a Series LLC in another state while operating in Florida.

| Benefits | Challenges |

| Asset protection between series | Limited state recognition |

| Simplified management structure | Complex accounting requirements |

| Potential tax advantages | Legal uncertainties in non-Series LLC states |

| Lower formation costs compared to multiple LLCs | Additional administrative responsibilities |

The structure works best for real estate investors, franchise operations, and businesses with distinct divisions or properties that need separation.

Some businesses find success by forming their Series LLC in Delaware while maintaining operations in Florida.

Confused about which LLC type fits your needs? Mary Conte Law helps Florida entrepreneurs choose the right structure for liability protection and tax benefits. Let’s build your business the right way—contact us now!

If you’re ready to get started, call us now!

Licensed professionals in Florida can protect their personal assets while meeting state licensing requirements through specialized business structures designed for their unique needs.

A Professional Limited Liability Company (PLLC) is a business entity specifically created for licensed professionals like doctors, lawyers, accountants, and architects.

PLLCs operate similarly to standard LLCs but must follow additional state regulations regarding professional licensing and conduct. Each owner, known as a member, must hold valid professional licenses in their field.

Florida law requires certain licensed professionals to form PLLCs instead of regular LLCs when starting their businesses. This ensures proper oversight and compliance with professional standards.

Key Benefits:

Important Limitations:

Licensed professionals in Florida who must form PLLCs include:

PLLCs work best for professionals who want liability protection while maintaining control over their practice. Solo practitioners and small professional groups often benefit most from this structure.

Professional practices with multiple licensed members can share ownership and management responsibilities while maintaining individual professional autonomy.

LLCs and corporations each provide unique benefits and drawbacks for business owners in Florida.

Both structures protect personal assets but differ significantly in their organization, tax treatment, and operational requirements.

Limited Liability Companies combine features of partnerships and corporations. They have members instead of shareholders and can be managed by the owners or appointed managers.

Corporations maintain a strict hierarchy with shareholders, directors, and officers. They must hold regular board meetings and keep detailed records of major decisions.

Ownership Structure:

Corporate tax treatment varies significantly between these entities. LLCs offer pass-through taxation by default, meaning profits flow directly to members’ personal tax returns.

C-corporations face double taxation – once at the corporate level and again when distributing dividends to shareholders.

S-corporations combine corporate structure with pass-through taxation, but they have strict eligibility requirements:

LLCs provide greater management flexibility and fewer administrative requirements. Members can structure operations through their operating agreement with minimal state interference.

Corporate entities require:

A corporation structure works best for companies planning to:

Large-scale businesses often prefer corporations because they offer:

Banking and investment firms typically feel more comfortable working with traditional corporate structures.

Selecting an LLC structure requires careful evaluation of your business goals, financial needs, and legal requirements.

The right choice will protect your assets while supporting your growth plans and tax preferences.

Starting a business in Florida means examining your current situation and future plans. Think about these key factors:

Business Scale:

Financial Requirements:

Business ownership structure affects daily operations and future opportunities. Consider these elements:

Management Style:

Legal Protection:

The LLC formation process in Florida follows specific requirements. Take these actions:

Watch for ongoing compliance requirements and keep accurate records. Review your structure annually to ensure it still meets business needs.

Choosing the right business entity is crucial for success. To help you navigate the process, we’ve created a comprehensive checklist that breaks down every step you need to form your Florida LLC. Scroll down to access your free, printable checklist!

| Step | Action | Details/Notes |

| 1 | Assess Your Business Needs | Define your business goals, scale, and capital requirements. |

| 2 | Determine LLC Structure | Choose between Single-Member, Multi-Member, or PLLC (Florida does not allow Series LLCs). |

| 3 | Understand Liability & Taxes | Confirm personal asset protection and tax benefits (pass-through taxation, zero state tax). |

| 4 | Plan Management Structure | Decide on member-managed vs. manager-managed; draft an operating agreement. |

| 5 | Choose a Business Name | Ensure it complies with Florida rules and includes “LLC” or “Limited Liability Company.” |

| 6 | Select a Registered Agent | Choose a reliable agent to receive legal and tax documents. |

| 7 | File Formation Documents | Submit Articles of Organization to the Florida Division of Corporations. |

| 8 | Draft an Operating Agreement | Outline ownership percentages, profit distribution, and dispute resolution. |

| 9 | Obtain Licenses & Permits | Secure local, state, and industry-specific permits and licenses. |

| 10 | Maintain Ongoing Compliance | File annual reports (by May 1) and keep accurate records. Consult professionals as needed. |

Your business deserves a strong foundation. Mary Conte Law simplifies LLC formation so you can focus on growth while staying legally protected. Start your Florida LLC today—book your consultation now!

What is an LLC, and why is it popular in Florida?

An LLC (Limited Liability Company) is a flexible business structure that combines liability protection with pass-through taxation. In Florida, LLCs are popular because they offer personal asset protection, ease of formation, and fewer formalities compared to corporations.

How does a Single-Member LLC differ from a Multi-Member LLC in Florida?

Does Florida allow Series LLCs?

Currently, Florida does not have statutory provisions that expressly authorize Series LLCs. Business owners interested in series-like structures may need to consider forming separate LLCs or explore formation in states that offer this option.

What is a Professional LLC (PLLC), and who needs one in Florida?

A PLLC is a specialized LLC designed for licensed professionals (such as doctors, lawyers, or accountants) who must form a professional entity under state law. PLLCs help ensure compliance with licensing requirements while providing limited liability protection.

How do Florida LLCs compare to corporations?

What factors should I consider when choosing the right LLC structure for my Florida business?

Consider the number of owners, desired management structure, liability concerns, tax implications, and long-term business goals. An operating agreement tailored to your needs is essential.

How does the operating agreement benefit a Florida LLC?

An operating agreement outlines each member’s rights and responsibilities, management procedures, profit and loss distribution, and dispute resolution mechanisms. This document is key to preventing conflicts and ensuring smooth operations.

When might a corporation be a better choice than an LLC in Florida?

A corporation might be preferable if you plan to attract outside investors, issue stock, or eventually go public. Corporations have more established structures for raising capital and may offer additional credibility in certain industries.